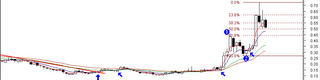

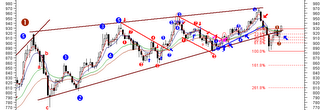

KLCI: My daily buy signal is triggered today. From the chart, looks like the next major resistance is at 980-1000.

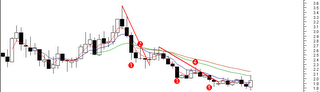

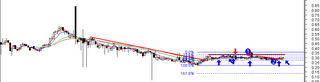

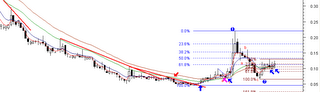

Novamsc: Consolidation over? A close above 0.13 will give it a better chance of going up.

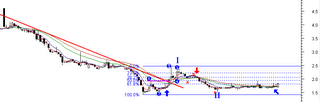

SimeEng: Making a move again. Looks like the move is before the 1 billion contract announcement.