If your stock goes up, better find a reason why. If not, Bursa will issue a query, making everyone nervous and dump it. Then you'll get stressful and have no good night sleep. If it is manipulated, then Bursa should check with the brokers. Find the left and right hand. With today's technology, you can tap phones, intercept emails etc. I'm sure Bursa knows the taikos. Most of the people most of the time will buy because it is up. There is no logic involve in buying, everthing is just emotionl decision. Where got time to read news or DJ Market Talk. With the amount of information available, I just give up.

Hmm....is there an indicator where we can predict when Bursa will issue a query? Maybe Bursa should be transparent about these, protection of minority speculators rights is a must. If we don't speculate, you don't make money. It will be a lose-lose situation.

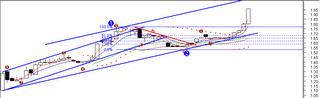

Wellcall

Wellcall: Going strong after CIMB strong buy call.

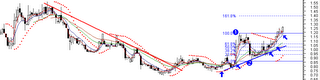

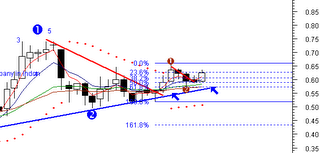

Mems

Mems: False break at 0.57. Under going correction. At support line. Possible buy if support holds. If not, it will be ugly for the bulls.

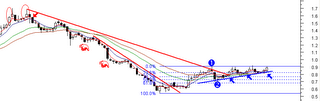

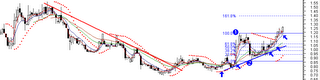

Maemode

Maemode: After 2 weeks of consolidation, Maemode is continuing the uptrend.