| New Warrants | Expiration | Type | Ex Price | Ratio |

| BURSA-CQ | 27/09/2011 | Call | MYR 7.8000 | 8 : 1 |

| PROTON-CD | 27/09/2011 | Call | MYR 4.6000 | 7 : 1 |

| TENAGA-CQ | 27/09/2011 | Call | MYR 8.5000 | 10 : 1 |

| RHBCAP-CD | 27/09/2011 | Call | MYR 6.5000 | 8 : 1 |

| CIMB-CJ | 27/09/2011 | Call | MYR 8.0000 | 10 : 1 |

| GENTING-CU | 27/09/2011 | Call | MYR 10.0000 | 10 : 1 |

Ads

Wednesday, September 29, 2010

6 New Call Warrants

Warrant time again! 6 new call warrants from OSK will be listed on 30 Sept 2010:

Monday, September 27, 2010

8 New Warrants

4 new call warrants from AM will be listed on 28 Sept 2010:

4 new warrants (1 call, 1 put, 1 bull, 1 bear) from CIMB will also be listed on 28 Sept 2010:

| New Warrants | Expiration | Type | Ex Price | Ratio |

| QL-CA | 14/09/2011 | Call | MYR 4.5000 | 6 : 1 |

| PROTON-CE | 14/09/2011 | Call | MYR 4.8500 | 8 : 1 |

| SAPCRES-CB | 14/09/2011 | Call | MYR 2.3800 | 3 : 1 |

| KENCANA-CD | 14/09/2011 | Call | MYR 1.5000 | 3 : 1 |

4 new warrants (1 call, 1 put, 1 bull, 1 bear) from CIMB will also be listed on 28 Sept 2010:

| New Warrants | Expiration | Type | Ex Price | Ratio | Call Price |

| HSI-CD | 29/09/2011 | Call | 20,000.00 | 3000 : 1 | |

| HSI-H2 | 29/09/2011 | Put | 20,000.00 | 3000 : 1 | |

| HSI-J1 | 29/06/2011 | Bull | 16,964.00 | 3000 : 1 | 18,024.00 |

| HSI-K1 | 29/06/2011 | Bear | 25,446.00 | 3000 : 1 | 24,386.00 |

Saturday, September 25, 2010

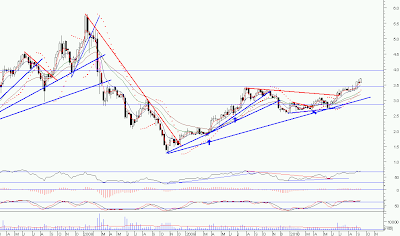

Interesting Charts: Property

Can BNM curb the steep rise in property price? Money always flow to an asset that the investor/speculator thinks that he can make money. For Malaysian, it is either the stock market or property. Since so many people still remembers the 1997/1998 crash, the natural choice for people in that era is property. Is property a bubble? Well, do you know anyone that have to queue up overnight to buy a house? If the answer is no, then it is not in a bubble phase yet.

Anyhow, keep a look out at the property stocks, it could still run up due to the inflation expectation.

SPSetia: Broke out from a triangle pattern, tested the breakout point and it seems that it is now going up again. If it can break 4.70, then the next resistance is at 5.20.

IJMLand: Trapped in a flag pattern. A look at the weekly RSI indicates that it could soon break out from this pattern. Breakout point is 2.50.

IGB: Looks like accumulation for the past 3 months. Could be making a move soon.

Glomac: The pattern is similar to SPSetia. Resistance is at around 1.65-1.75.

E&O: Trying to breakout. Weekly RSI indicates that this is going to happen soon.

Disclosure: Long SPSetia, IJMLand and E&O.

Anyhow, keep a look out at the property stocks, it could still run up due to the inflation expectation.

SPSetia: Broke out from a triangle pattern, tested the breakout point and it seems that it is now going up again. If it can break 4.70, then the next resistance is at 5.20.

IJMLand: Trapped in a flag pattern. A look at the weekly RSI indicates that it could soon break out from this pattern. Breakout point is 2.50.

IGB: Looks like accumulation for the past 3 months. Could be making a move soon.

Glomac: The pattern is similar to SPSetia. Resistance is at around 1.65-1.75.

E&O: Trying to breakout. Weekly RSI indicates that this is going to happen soon.

Disclosure: Long SPSetia, IJMLand and E&O.

World Market Weekly Summary

It seems that the inflation play is now on! Commodities are all performing very well now. In a fiat currency system, one can always devalue the currency to prevent deflation. If Uncle Ben cannot kill the deflation threat will bullets, then he is sure going to bomb it out!

Look at the Dollar Index chart, it indicates that the USD is gonna have another selldown. We should be seeing MYR under 3 to a USD by end of this year. Hopefully, imported goods will be more affortable for us.

World market summary:

Look at the Dollar Index chart, it indicates that the USD is gonna have another selldown. We should be seeing MYR under 3 to a USD by end of this year. Hopefully, imported goods will be more affortable for us.

World market summary:

| World | Monthly | Weekly | Daily |

| S&P500 | Neutral | Up | Up |

| DJI | Neutral | Up | Up |

| NasdaqComp | Neutral | Up (+) | Up |

| Nikkei 225 | Down | Neutral | Up (+) |

| Kospi | Up | Up | Up |

| SSECI | Down | Down (-) | Neutral |

| HSI | Up | Up | Up |

| TWII | Up | Up | Up |

| STI | Up | Up | Up |

| JKSE | Up | Up | Up |

| SENSEX | Up | Up | Up |

| AORD | Neutral | Up | Up |

| NZX50 | Neutral | Up | Up |

| FTSE | Neutral | Up | Up |

| DAX | Up | Up | Up |

| RTSI | Up | Up | Up (+) |

| Bovespa | Up | Up | Up |

Friday, September 24, 2010

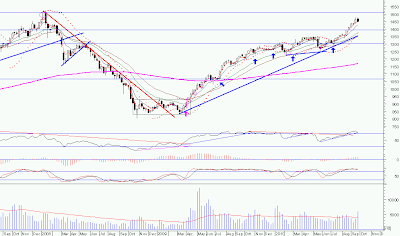

Bursa Malaysia Weekly Summary

A bearish reversal candle in the weekly chart. Not a good sign! Today's high volume indicates that the baton is now being passed from bluechips to penny shares. When penny shares are hot, it signals the beginning of the end! 4 more trading days left for the fund managers to window dress their 3rd quarter account. What will happen after that? A correction before the year end window dressing?

Sector summary:

| Malaysia | Monthly | Weekly | Daily |

| FBM KLCI | Up | Up | Neutral (-) |

| Finance | Up | Up | Neutral (-) |

| Construction | Up | Up | Up |

| Plantation | Up | Up | Neutral (-) |

| Property | Up | Up | Up |

By the way, this fengshui index chart that I posted on 14 Feb 2010 looks very interesting. The chart does correlate with HSI & KLCI. Better don't short the market!

Wednesday, September 22, 2010

Monday, September 20, 2010

World Market Weekly Summary

More upgrades than downgrades. The market just refused to die. JKSE, Kospi and Sensex are the superstars!

| World | Monthly | Weekly | Daily |

| S&P500 | Neutral | Up (+) | Up (+) |

| DJI | Neutral | Up | Up (+) |

| NasdaqComp | Neutral (+) | Neutral | Up (+) |

| Nikkei 225 | Down | Neutral (+) | Neutral |

| Kospi | Up | Up | Up |

| SSECI | Down | Neutral | Neutral (-) |

| HSI | Up | Up | Up |

| TWII | Up | Up | Up |

| STI | Up | Up | Up |

| JKSE | Up | Up | Up |

| SENSEX | Up | Up | Up |

| AORD | Neutral (+) | Up (+) | Up |

| NZX50 | Neutral | Up (+) | Up |

| FTSE | Neutral | Up | Up |

| DAX | Up | Up | Up |

| RTSI | Up | Up | Neutral (-) |

| Bovespa | Up | Up | Up |

Saturday, September 18, 2010

Bursa Malaysia Weekly Summary

Daily, weekly and monthly chart is in overbought zone. No bearish divergence detected. If you have missed the strongest sector (i.e. finance), then maybe you can catch the tail wind of the the weakest sector (i.e. property and construction). Good luck!

Sector summary:

| Malaysia | Monthly | Weekly | Daily |

| FBM KLCI | Up | Up | Up |

| Finance | Up | Up | Up |

| Construction | Up | Up | Up |

| Plantation | Up | Up | Up |

| Property | Up | Up | Up (+) |

Wednesday, September 15, 2010

Interesting Charts: Construction

Salcon: May have broken it's downtrend line which was formed since listing day! This makes you wonder what type of IPO junk they throw to the retailer.

MRCB: Moving within a uptrend channel. Now almost at the upper-side of the channel.

WCT: Consolidated for 14 months at the 2.50-2.80 range. A false break in April 2010. Is this for real now?

IJM: Looks like it has broken its downtrend line. The next one is the upper-side of a rising flag.

A close above 5.20 should allow it to zoom up to 6.40.

Gamuda: This is the leader in the construction sector. Next resistance is around 4.00.

Disclosure: Long in IJM and Salcon.

Tuesday, September 14, 2010

6 New OSK Call Warrants

6 new call warrants from OSK will be listed on 15 Sept 2010:

| New Warrants | Expiration | Type | Ex Price | Ratio |

| AIRASIA-CI | 12/9/2011 | Call | MYR 1.8000 | 2 : 1 |

| AMMB-CI | 12/9/2011 | Call | MYR 5.7000 | 7 : 1 |

| TM-CO | 12/9/2011 | Call | MYR 3.1000 | 4 : 1 |

| GAMUDA-CM | 12/9/2011 | Call | MYR 3.3500 | 5 : 1 |

| JCY-CC | 12/9/2011 | Call | MYR 1.0800 | 2 : 1 |

| GENS-C8 | 12/9/2011 | Call | SGD 1.7000 | 6 : 1 |

Saturday, September 11, 2010

Money Makes Money

How to use your money to make money? Ok, I spent some time in looking into this issue. The result is the chart above. The chart is not 100% accurate, just a generalizations of the various instruments that I know of. The difficult part is the derivatives. There are so many variants and I don't understand most of them.

Any comments are welcomed.

World Market Weekly Summary

Market just cannot drop. Most probably too much money chasing for yield. My speculation is that US banks are not lending because the economy still sucks. So, to continue making money to pay off their losses, most probably they are speculating the market. What say you?

| World | Monthly | Weekly | Daily |

| S&P500 | Neutral | Neutral | Neutral |

| DJI | Neutral | Up (+) | Neutral |

| NasdaqComp | Down | Neutral (+) | Neutral |

| Nikkei 225 | Down | Down | Neutral |

| Kospi | Up | Up | Up |

| SSECI | Down | Neutral | Up |

| HSI | Up | Up (+) | Up (+) |

| TWII | Up | Up | Up (+) |

| STI | Up | Up | Up |

| JKSE | Up | Up | Up |

| SENSEX | Up | Up | Up |

| AORD | Down | Neutral | Up |

| NZX50 | Neutral (+) | Neutral | Up |

| FTSE | Neutral | Up | Up |

| DAX | Up | Up (+) | Up (+) |

| RTSI | Up | Up | Up |

| Bovespa | Up | Up | Up |

4 New Warrants

3 new call warrants and 1 new bull warrant from CIMB will be listed on 13 Sept 2010:

| New Warrants | Expiration | Type | Ex Price | Ratio | Call Price |

| GENS-J1 | 7/6/2011 | Bull | SGD 1.2800 | 6 : 1 | SGD 1.3600 |

| GENS-CA | 7/9/2011 | Call | SGD 1.4500 | 4 : 1 | |

| GENS-CB | 7/9/2011 | Call | SGD 1.7000 | 4 : 1 | |

| TOYOTA-C4 | 7/9/2011 | Call | JPY 3,000.0000 | 100 : 1 |

Thursday, September 09, 2010

Bursa Malaysia Weekly Summary

Uptrend now being sustained by plantation sector. When you see penny counters are in the top-10 volume, that is the sign that the trend is at the tail end.

Sector summary:

| Malaysia | Monthly | Weekly | Daily |

| FBM KLCI | Up | Up | Up |

| Finance | Up | Up | Up |

| Construction | Up | Up | Up |

| Plantation | Up | Up | Up |

| Property | Up | Up | Neutral (-) |

Tuesday, September 07, 2010

Friday, September 03, 2010

Bursa Malaysia Weekly Summary

I missed out the weekly RSI downtrend line. It seems the weekly RSI downtrend line has been broken about 3 weeks ago. That means the bearish divergence has been negated. Since weekly and daily chart are both in the overbought zone, we need to move to the monthly chart. It seems that the monthly RSI is just slightly over the overbought zone.

All sectors are positive now:

| Malaysia | Monthly | Weekly | Daily |

| FBM KLCI | Up | Up | Up |

| Finance | Up | Up | Up |

| Construction | Up | Up | Up (+) |

| Plantation | Up | Up | Up |

| Property | Up | Up | Up (+) |

If this whole thing gonna blow over, then the laggards (property & construction) must rally and then go kaboom!

Subscribe to:

Posts (Atom)