| New Warrants | Expiration | Type | Ex Price | Ratio |

| AXIATA-HA | 25/08/2010 | Put | MYR 3.4000 | 5 : 1 |

| GENM-HA | 25/08/2010 | Put | MYR 3.0000 | 4 : 1 |

| IOICORP-HA | 25/08/2010 | Put | MYR 5.6000 | 8 : 1 |

| GENS-C2 | 25/08/2010 | Call | SGD 1.0600 | 6 : 1 |

Ads

Wednesday, September 30, 2009

Axiata, IOICorp, Genm, Gens Put/Call Warrants

Kudos to OSK for issuing 3 put warrants for Axiata, IOICorp and Genm! The following will be listed on 1 Oct 2009:

Monday, September 28, 2009

Commodity Summary

USD may rebound. That is why a weakness in commodities:

| Commodity | Monthly | Weekly | Daily |

| Gold | Up | Up | Neutral (-) |

| Crude Oil | Up | Neutral (-) | Down (-) |

| Crude Palm Oil | Neutral | Down | Neutral |

| Rough Rice | Up | Neutral (-) | Down (-) |

Weekly World Summary

A little bit late:

Every markets have weakened. Going up is a battle now. Going down is easier. However, no sign of massive selldown in the charts yet.

| World | Monthly | Weekly | Daily | Note |

| S&P500 | Up | Up | Neutral (-) | R=1.12k |

| DJI | Up | Up | Neutral (-) | R=10.1k. |

| NasdaqComp | Up | Up | Neutral (-) | R=2.18k |

| Nikkei 225 | Up | Up | Neutral (-) | Next R=11k |

| Kospi | Up | Up | Up | R=1.9k. Overbought |

| SSECI | Up | Neutral | Down (-) | R=3.5k. S=2.6k. Finding base. |

| HSI | Up | Up | Neutral (-) | R=23.5k, S=20k. |

| TWII | Up | Up | Neutral (-) | R=7.9k. S=7k |

| STI | Up | Up | Up | R=2.7k. |

| JKSE | Up | Up | Up | R=2.5k. S=2.3k |

| SENSEX | Up | Up | Up | R=17.6k |

| AORD | Up | Up | Up | R=4.9k |

| NZX50 | Up | Up | Neutral (-) | R=3.2k |

| FTSE | Up | Up | Neutral (-) | R=5.4k |

| DAX | Up | Up | Neutral (-) | R=6.15k |

| RTSI | Up | Up | Up | R=1.25k |

| Bovespa | Up | Up | Up | R=66k |

Every markets have weakened. Going up is a battle now. Going down is easier. However, no sign of massive selldown in the charts yet.

Saturday, September 26, 2009

Enhanced Warrant Calculator Database

I have updated my Bursa Malaysia Warrant Calculator with selected call/put warrants that are listed in Hong Kong and Singapore (see figure above). This gives traders a mean to compare how the same warrants is being valued in other exchanges. I'm now searching for a brokerage that allows me to trade through Internet the Hong Kong warrants. There are so many warrants in Hong Kong. I would say Hong Kong is a warrant heaven! Well, if you cannot get to trade put warrants in Malaysia, might as well move to Hong Kong markets.

Astro, Kencan, Sapcres, HSI CW

More call warrants from CIMB that will be listed on 28 Sept 2009:

I'm really disappointed that CIMB is still refusing to issue put warrants. How hard can it be? Don't tell me that there is no market because they have so many call warrants that is hardly traded at all. I hope that AmInvestment Bank will issue more call/put warrants.

| New Warrants | Expiration | Type | Ex Price | Ratio |

| ASTRO-CC | 24/09/2010 | Call | MYR 3.4000 | 4 : 1 |

| KENCANA-CA | 24/09/2010 | Call | MYR 2.0000 | 3 : 1 |

| SAPCRES-CA | 24/09/2010 | Call | MYR 1.6500 | 3 : 1 |

| HSI-C8 | 29/09/2010 | Call | 20,500.00 | 10000 : 1 |

I'm really disappointed that CIMB is still refusing to issue put warrants. How hard can it be? Don't tell me that there is no market because they have so many call warrants that is hardly traded at all. I hope that AmInvestment Bank will issue more call/put warrants.

Weekly Summary

A short 3-day week. Bluechips have stopped moving. The attention now is on the small caps. Looks like weakness is coming into KLCI. Most probably it will correct. Summary for the various sectors:

| Malaysia | Monthly | Weekly | Daily | Note |

| FBM KLCI | Up | Up | Up | R=1.3k, S=1.15k. Overbought |

| Finance | Up | Up | Up | R=10k, S=9k |

| Construction | Up | Up | Up | R=250, S=220 |

| Plantation | Up | Up | Up | Broke out of downtrend. |

| Property | Up | Up | Up | R=820, S=760 |

| FBM ACE | Up | Neutral | Neutral (+) | Consolidation. |

Friday, September 25, 2009

Jeff Rubin on CNBC

Jeff Rubin talks about how the world is going to get smaller. He is the author of the book "Why Your World Is About to Get a Whole Lot Smaller: Oil and the End of Globalization"

Wednesday, September 23, 2009

Dollar Index

Daily chart indicates that the downward movement may accelerate.

At (or almost - depending on RSI or Stochastic) oversold. A break of 76 means a possible visit to 72.

Implications of a dropping dollar: an inflation of asset prices.

Looks like it has broken a H&S formation. Hurray for companies with large foreign debt (i.e. Tenaga and IOICorp)

Sunday, September 20, 2009

Weekly Commodity Summary

Gold has broken out and close at a new weekly high. I'm expecting it to go up further even though IMF is selling 400 tons of gold. It's a mania for gold and nothing will stop its ascends.

For crude oil, it is still trap within a ascending triangle. Watch out for the breakout!

Summary for this week:

| Commodity | Monthly | Weekly | Daily |

| Gold | Up | Up | Up |

| Crude Oil | Up | Up | Up (+) |

| Crude Palm Oil | Neutral | Down | Neutral (+) |

| Rough Rice | Up | Up | Neutral |

Weekly World Markets Summary

Looking at the SSECI monthly chart, if it can maintain at current level, we should see another upward movement towards 5000-6000!

DJI should challenged it's downtrend line (around 10,100) soon. The bulls can still run and it is not tired yet.

For the rest of the world, it seems pretty bullish at the moment.

| World | Monthly | Weekly | Daily | Note |

| S&P500 | Up | Up | Up | R=1.12k |

| DJI | Up | Up | Up | R=10.1k. |

| NasdaqComp | Up | Up | Up | R=2.18k |

| Nikkei 225 | Up | Up | Up | Next R=11k |

| Kospi | Up | Up | Up | R=1.9k. Overbought |

| SSECI | Up | Neutral | Neutral | R=3.5k. S=2.6k. Finding base. |

| HSI | Up | Up | Up | R=23.5k, S=20k. |

| TWII | Up | Up | Up | R=7.9k. S=7k |

| STI | Up | Up | Up | R=2.7k. |

| JKSE | Up | Up | Up | R=2.5k. S=2.3k |

| SENSEX | Up | Up | Up | R=17.6k |

| AORD | Up | Up | Up | R=4.9k |

| NZX50 | Up | Up | Up | R=3.2k |

| FTSE | Up | Up | Up | R=5.4k |

| DAX | Up | Up | Up | R=6.15k |

| RTSI | Up | Up | Up | R=1.25k |

| Bovespa | Up | Up | Up | R=66k |

Friday, September 18, 2009

SPSetia and Genm

SPSetia has given me a buy signal based on the daily chart. Weekly chart still indicates an uptrend. The only worry is that its momentum is still weakening. A close above 4.50 will indicate a breakout, which means that a good chance of breaking 4.70. Any breakdown should find support at around 3.90.

Genm has given me a buy signal based on daily chart. This is still a downtrend stock. Downtrend line resistance is at 3.00. A close above 3.00 means that it can possibly go to 3.50.

Disclosure: Long in SPSetia, no position in Genm.

Weekly Summary

Still heading up. No resistance until 1280. Daily and weekly is overbought. I just realized that it is almost at the end of 3rd quarter. No wonder the bluechips are pushed up one by one. Someone really want to massage his/her performance.

Nothing to say but just enjoy the ride up.

The sector summary is given below:

| Malaysia | Monthly | Weekly | Daily | Note |

| FBM KLCI | Up | Up | Up | R=1.3k, S=1.15k. Overbought |

| Finance | Up | Up | Up | R=10k, S=9k |

| Construction | Up | Up | Up | R=250, S=220 |

| Plantation | Up | Up | Up | Broke out of downtrend. |

| Property | Up | Up | Up | R=820, S=760 |

| FBM ACE | Up | Neutral | Down | Down or consolidation. |

Enjoy the long weekend and Selamat Hari Raya to all Muslim readers.

Warrant Calculator 2.1

Ok, I finally found the time to make some upgrade to my Bursa Malaysia Warrant Calculator. I killed the forex bug that I accidentally discovered while adding the following new features:

- Underlying Stock Price - now you can key in the price that you desired. It gives you a better computation as compared to the automatically retrieved data which is delayed by 10 minutes.

- Warrant Price - you can also key in the price now. This eliminates the problem for those no transaction warrants. Furthermore, you can now use it to compute the premium based on the buying/selling bid.

I like this warrant calculator because it allows me to easily identify undervalue warrants. With so many warrants being issued, I believe that this is a great tool for any warrant addicts. For only 6EUR, you will get this great tool with 1 year of data update. Have a try of my Bursa Malaysia Warrant Calculator today and experience the power that it gives you!

Thursday, September 17, 2009

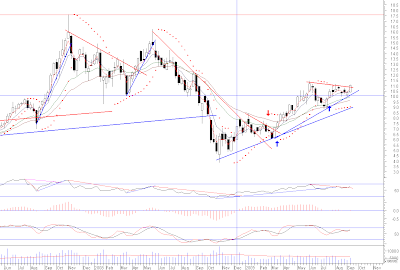

Crude Oil

Crude Oil Daily Chart

Looks like a triangle in the making. Breakout point is 75.00. Breakdown point is 69.00.

The trend is still up. A break of 75.00 means that it will challenge the next resistance at 80.00. Support at 69.00 and 60.00.

A few Malaysian oil and gas counters have moved. Be prepared for the rest if the breakout happens.

Global Public Debt

Happy Malaysia Day! In 2009, the public debt per capita for Malaysia is USD3,340.86. In 2010, it is USD3,890.25 while in 2011, it is USD4,511.25! Growth by debt is goooood! How come we have so much oil and still in debt (and increasing too)? Where has our money gone to? Perhaps here.

The Economist has a very nice animation about the world's public debt. You can see how much is our debt as compared to our GDP. No wonder our money has no value. Is it MYR2.45 to a Sing now?

Monday, September 14, 2009

IJMLand

Sunday, September 13, 2009

Weekly Commodity Summary

Looks like a clean break for gold. Based on the triangle height, can go another 100.00.

Crude oil overhead resistance at around 75.00. Don't think it can go any further based on the weekly momentum that is getting weaker. Could be a double top or a rising wedge formation. Still to early to say.

Looks like CPO is going into bear mode. However, I'm still expecting 2000.00 to be the support.

Saturday, September 12, 2009

World Market Summary

Correction in Shanghai could be over and currently in a base building phase. I think that it will go up and down around the 3000 region for a while until the next move. There is a gap at 3030 that is waiting to be close.

HSI continues to move higher. The next resistance is around 23000.

S&P 500 continues to move higher too. It could be at the top of end of a rising wedge formation. Will it be able to close its small gap at around 1100? If it can move higher, then 1100 (downtrend line) will be the point to watch.

All markets moved higher last week. Most of them broke their resistance area:

| World | Monthly | Weekly | Daily | Note |

| S&P500 | Up | Up | Up (+) | R=1.13k |

| DJI | Up | Up | Up (+) | R=9.8k. Daily bearish divergence |

| NasdaqComp | Up | Up | Up | R=2.18k |

| Nikkei 225 | Up | Up | Up (+) | Next R=11k |

| Kospi | Up | Up | Up | R=1.9k |

| SSECI | Up | Neutral | Neutral | R=3.5k. S=2.6k. Finding base. |

| HSI | Up | Up | Up (+) | R=23.5k, S=20k. |

| TWII | Up | Up | Up | R=7.4k. S=6.6k |

| STI | Up | Up | Up | R=2.7k. |

| JKSE | Up | Up | Up (+) | R=2.4k. S=2.1k |

| SENSEX | Up | Up | Up | R=17.6k |

| AORD | Up | Up | Up (+) | R=4.6k |

| NZX50 | Up | Up | Up | R=3.2k |

| FTSE | Up | Up | Up (+) | R=5.1k |

| DAX | Up | Up | Up (+) | R=6.15k |

| Bovespa | Up | Up | Up (+) | R=58k |

I still detect a significant number of bears. I think that this market will continue to move higher until all of the bears surrender.

Jim Rogers on Technical Analysis

Pay no attention to those who talk down on technical analysis, just know who you are and what you can do. Select a method that suits you and stick to it:

If you are good at technical analysis, you will be successful. I personally do not use technical analysis and people have told me they do and they make money. You can analyse anything – bonds, commodities, forex, anything – if you are good at it. Many people use technical analysis and don’t succeed. But if you are good at it, you will succeed and you can trade in whatever you want.

- Jim Rogers

Source: Your 10 Questions - Jim Rogers

Friday, September 11, 2009

Weekly Summary

The first gap at just below 1200 is now covered. The next gap is at 1350 (pink circle). Will KLCI cover this one too? Weekly momentum continue to weakened. Volume also continue to reduce because the penny shares are not drawing any interest. However, comparing the volume week-by-week, there was a slight increase. Only the bluechip shares that are currently being pushed up. You can notice that the bluechip shares take turns to go up (Monday was KLK/Tenaga, Tuesday was IOICorp/Sime, Thursday was IJM, Friday was CIMB/PBBank).

| Malaysia | Monthly | Weekly | Daily | Note |

| FBM KLCI | Up | Up | Up | R=1.3k, S=1.15k |

| Finance | Up | Up | Up | R=10k, S=9k |

| Construction | Up | Up | Up | R=250, S=220 |

| Plantation | Up | Up | Up (+) | Broke out of downtrend. |

| Property | Up | Up | Up (+) | Finding a base. |

| FBM ACE | Up | Neutral | Down (-) | Down or consolidation. |

The summary for various sectors is given above. Plantation index has broken out of the downtrend again. Will this hold or another fake break? I think that this one is not a fake out. So, watch out on plantation counters. I'm currently just sitting tight with my positions. My property counters are working nice last week. IJMLand and E&O continue to move up. Only SPSetia still refuse to run. Most probably SPSetia will run next week. Hopefully, next week is also a good week.

Tuesday, September 08, 2009

TM, KNM, IOICORP, SINOPEC Call Warrants

New call warrants from CIMB to be listed on 9 Sept 2009:

| New Warrants | Expiration | Type | Ex Price | Ratio |

| IOICORP-CM | 7/9/2010 | Call | MYR 5.0000 | 8 : 1 |

| KNM-CC | 7/9/2010 | Call | MYR 0.7000 | 2 : 1 |

| TM-CK | 7/9/2010 | Call | MYR 3.0000 | 3 : 1 |

| SINOPEC-C6 | 7/9/2010 | Call | HKD 7.0000 | 5 : 1 |

China encourages Silver Bullion for investment

Some bullish silver news. I'm not sure when was this reported. Could be July 2009.

Monday, September 07, 2009

FBMKLCI Up Due to Myolie

FBMKLCI gained 11.65 points on 7 Sept 2009 to 1190.39 as Hong Kong beauty Myolie says that she may date Malaysian men. Her quest for love boosted the ego of testosterone full traders and fund managers of Bursa Malaysia as it shows that Malaysian men are still desired by Hong Kong women.

Ok ok, I made that up. This fantasy writing is no difference than what you read in your financial newspaper. Nobody knows why the market goes up or down. It is the effect of thousands and millions of people. Reporters just find an interesting story and declare it as the cause of some dramatic movement.

So, treat everything you read just as an entertainment. Don't be fooled by the news, it may just be some propaganda to encourage you to bid up the price. Nothing is what they seems to be.

International Reserves of BNM

Reserves as at 28 August 2009, almost an increase of USD2 billion as compared to two weeks ago! Hot money?

Reserves as at 28 August 2009, almost an increase of USD2 billion as compared to two weeks ago! Hot money?

China alarmed by US money printing

I don't know who is Cheng Siwei, but what he said corresponds to my speculation theme:

- Cheng Siwei, former vice-chairman of the Standing Committee and now head of China's green energy drive, said Beijing was dismayed by the Fed's recourse to "credit easing".

- "If they keep printing money to buy bonds it will lead to inflation, and after a year or two the dollar will fall hard. Most of our foreign reserves are in US bonds and this is very difficult to change, so we will diversify incremental reserves into euros, yen, and other currencies," he said.

- "Gold is definitely an alternative, but when we buy, the price goes up. We have to do it carefully so as not to stimulate the markets," he added.

- "Credit in China is too loose. We have a bubble in the housing market and in stocks so we have to be very careful, because this could fall down."

I like this quote: "He who goes borrowing, goes sorrowing"

Original source from The Telegraph

Subscribe to:

Posts (Atom)