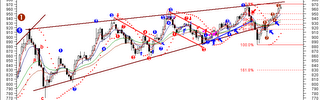

Is it over? Daily chart indicates a correction is imminent. Weekly chart does not yet indicate the trend is over. Possibly the correction will go to 950. The volume does not indicate an exhaustion rally. It is too low. Does this indicate that it is a bear rally? Not possibly because weekly indicators are all positive. Past 2 years weekly RSI analysis shows that there should be 2 overbought peaks before we have a major correction.

My intepretation from all of these is that there will be a mild correction, then another rally, maybe pass 970 to draw out the crowds, then maybe we will have a major correction.

The next move should involve bigger caps as SC is coming hard on small speculative counters. Smart taikos will do the tango to avoid any enquiries (i.e. mems)

A few of my counters stop lost has been hit. Time to weed out the weaklings.

No comments:

Post a Comment