I don't know what to say. The pro trader Michael keeps coming back to this blog to give a word or too. If this blog is so bad, so what make him/her keep coming back? There is no information from this blog that are any used to him/her.

Maybe he/she has won so much money that he/she has nothing to do but to give "advice" to the novices. Boredom? I can imagine the sadistic smile in his/her face when I got it wrong.

Well...I know what will I do if I turn pro. Play the world market! The world is round. There will always be a market open some where. Why would I waste my time with stupid blogs? There are gazillion dollars/euros to be made. Indonesia has gained 200%, Nikkei looks like making a wave 3. India is still moving up. Shenzen is hot. Then you have the DAX, Nasdaq, NYSE....That is what I will do if I turn to pro.

Ads

Thursday, December 21, 2006

Sunday, December 17, 2006

KLCI

Holding Power

What is holding power? I think to answer this question, you need to answer what is your time frame. Day traders has less than 6 hours of holding power. Contra traders has less than 4 days of holding power, medium term traders may have 1-3 months of holding power while long term traders may have have years of holding power. So depends on the type of trader you are and the period of chart you used, you will have different level of holding power. There is nothing right or wrong about holding power, it's only your perception of time frame. So analyze yourself and select stocks that suits your style.

For me, I have different time frame for different stocks. It depends on how much to I believe on it's fundamental potential. Some are only for short term play. Some are long term play. And some short term becomes long term :p

For me, I have different time frame for different stocks. It depends on how much to I believe on it's fundamental potential. Some are only for short term play. Some are long term play. And some short term becomes long term :p

Thursday, December 14, 2006

Major or minor correction?

Got stop out of Favco and Nextnat. Nextnat is tricky, always last minute push up. What's up with this?

I have also sold out my Maemode-WA. Maemode seems to be not moving anymore.

Currently, the weekly RSI uptrend line for KLCI has been broken. More downside? Or just to flush out people like me?

I have also sold out my Maemode-WA. Maemode seems to be not moving anymore.

Currently, the weekly RSI uptrend line for KLCI has been broken. More downside? Or just to flush out people like me?

Saturday, December 09, 2006

Misses and Hits

What a craze on bluechips CAs. Too bad I did not anticipate it. What will be the next craze?

Some of my sleeping counters are starting to move again. Wellcall...I missed out on adding more position. It moved too fast away from my stop loss. Stalking for the next entry point. GHLSys finally breaks out of consolidation range, hopefully more actions to come. Mems gives me a scare when it suddenly moves down...but recovered by the end of the week.

I manage to add some for Masteel. Maybe the next craze is in steel? Now, waiting anxiously for Measat. I pry that the launch will be successful. I added a few immediately when Arabsat was successfully launch (it took 4 full trading days for the market to play on this news....). Favco is more good to me this time (last time I have to take a loss). I also added a little of Media-Wa. Will Media go further?

Some of my sleeping counters are starting to move again. Wellcall...I missed out on adding more position. It moved too fast away from my stop loss. Stalking for the next entry point. GHLSys finally breaks out of consolidation range, hopefully more actions to come. Mems gives me a scare when it suddenly moves down...but recovered by the end of the week.

I manage to add some for Masteel. Maybe the next craze is in steel? Now, waiting anxiously for Measat. I pry that the launch will be successful. I added a few immediately when Arabsat was successfully launch (it took 4 full trading days for the market to play on this news....). Favco is more good to me this time (last time I have to take a loss). I also added a little of Media-Wa. Will Media go further?

Saturday, December 02, 2006

Bullish Sentiment

I never discuss about my share trading with my family. My parents never invested in stock directly. For them, it is too risky. The tried unit trust but the performance was terrible. So, stocks are not their interest. Well, the last time my dad mentioned about the stock market was when KLCI drop from 960 to 890 (May 06). He was concerned about my position and asked me to get out of the market. That time was around 900.

Today, my dad mentioned about the stock market again. He is asking me to hang on for more gain. He is getting very excited.

Hmmm...Should I do the reverse?

Today, my dad mentioned about the stock market again. He is asking me to hang on for more gain. He is getting very excited.

Hmmm...Should I do the reverse?

Tuesday, November 28, 2006

Correction or consolidation

The higher you go up, the harder you fall. Look at Hang Seng and Jakarta, falling 2.9% and 2.2% respectively.

So, is this just a minor correction or the beginning of a consolidation? I think it depends on Malaysian currency against USD. Still cannot break 2.63.

Anyhow, for the foreign funds, I think they are content with the coming Christmas bonus.

So...maybe we shall have a month long consolidation until next year. So what will the fire pig brings us? Any hints from Mr. Market?

So, is this just a minor correction or the beginning of a consolidation? I think it depends on Malaysian currency against USD. Still cannot break 2.63.

Anyhow, for the foreign funds, I think they are content with the coming Christmas bonus.

So...maybe we shall have a month long consolidation until next year. So what will the fire pig brings us? Any hints from Mr. Market?

Sunday, November 26, 2006

Currency effect

I think I know why I'm feeling so uneasy with the rally this week. It has got to do with the currency. Coincidently, I tried out Deutsche Bank Forex demo program this week. I don't have the money to play with Forex (min USD50k) but I tried it just for fun. What a beginners luck I had with the forex. I bought GBP against the USD and earn 25% in a day. So I check the Forex chart and I discover that major currencies are in a long term uptrend against the USD. Furthermore, the EUR has just broke free of a symmetrical triangle against the USD. USD was really getting whack! So what does this got to do with stocks?

Well, if I'm investing in US stocks, most probably I will sell them and convert it to EUR or whatever to avoid currency loss (just like 1997). If everyone thinks like that, then US stocks will go down.

The next question is how will this affect Malaysia? If US sentiment is bad, most probably it will affect us also. I'm not sure what will be the correlation this time.

If you read the newspaper, they always says that the rally is due to foreign buying. So what will the foreigner do? If MYR keeps tagging with the USD, I think they will sell. If MYR breaks free of the 3.63, then they will continue to buy. Last check at the BNM website shows that MYR is still trading around 3.63. So what will it be?

Well, if I'm investing in US stocks, most probably I will sell them and convert it to EUR or whatever to avoid currency loss (just like 1997). If everyone thinks like that, then US stocks will go down.

The next question is how will this affect Malaysia? If US sentiment is bad, most probably it will affect us also. I'm not sure what will be the correlation this time.

If you read the newspaper, they always says that the rally is due to foreign buying. So what will the foreigner do? If MYR keeps tagging with the USD, I think they will sell. If MYR breaks free of the 3.63, then they will continue to buy. Last check at the BNM website shows that MYR is still trading around 3.63. So what will it be?

Saturday, November 25, 2006

Comments are welcome

I don't have any privilege information. I don't get tips or whatever information except those published in the newspaper. Look at MPHB, I have no clue why it goes up like that. The most probable cause I can conclude is "the syndicate". If syndicate is involved, I just conclude that based on past charts, it can reverse as fast. So I took profit for my MPHB-WB. But the news is out now, the "reason" is MPHB is making a GO for Magnum. The price is definately not attractive for Magnum holders (no wonder it can't break 2.30). I guess MPHB will continue going up, too bad for me. But I don't regret my decision as it is based on what was at my disposal at that moment. Anyhow, I will learn from this experience and design a more flexible strategy.

Anyway, I don't mind any comments posted. Good or bad, it is fun to read. At least someone is paying some attention to this blog :p

Anyway, I don't mind any comments posted. Good or bad, it is fun to read. At least someone is paying some attention to this blog :p

Friday, November 24, 2006

Don't know zone

Yes, I am in the don't know zone. All my indicators for the KLCI is super overbought. Maybe it's no use to use them anymore, maybe we should just buy blindly. I don't have a system for superbought condition. I'm not take old to know what is the superbull. So I decided to sell stocks that moves up like someone with an overdose of viagra. For my buying decision, I only buy 1/2 position as compared to normal (just in case it didn't turn out fine). I have been caught during the 2004 downturn, so I try not to be caught again with my pants down. I think that it is important to make profit during the bull, but the most important is not to lost all back during the bear.

Thursday, November 23, 2006

Still going up?

It's amazing that the index is still going up. Anyhow, I started to cut some of my counters as I'm not comfortable with my position. I'm totally out of Gamuda-WC, partially out of Maxis-CA and MPHB-WB. MPHB and Maxis looks very strong indeed. But I don't think I can sleep well during the correction (i'm getting jittery - still need to control my emotion).

New counters that I bought this week are Favco (one more try since I lost the last time) and Coastal (moving up again?) I'm also eyeing Maemode-WA. Counters that I'm still holding are Media-WA and Measat.

If KLCI is going into correction (it's almost at the end of reporting season), I do hope that it will be gradual and slow (at least there will be play on 2nd and 3rd liners counters). Let's see what the market will do tomorrow.

New counters that I bought this week are Favco (one more try since I lost the last time) and Coastal (moving up again?) I'm also eyeing Maemode-WA. Counters that I'm still holding are Media-WA and Measat.

If KLCI is going into correction (it's almost at the end of reporting season), I do hope that it will be gradual and slow (at least there will be play on 2nd and 3rd liners counters). Let's see what the market will do tomorrow.

Monday, November 20, 2006

Correction coming?

Hmmm...if you read the news, you can see that many analysis are giving high targets for KLCI. Very bullish indeed. I believe their calls are to lure the last of the buyers. Today's KLCI action worries me. I think that we are heading into at least a 30% correction using wave theory (around 1000?). Funds don't have to push anymore since their account will definately look good at year end. If rally halted, I think it will be restarted for the CNY play (early 2007).

Let's see what happens next.

Let's see what happens next.

Tuesday, November 14, 2006

Cut Cut Cut

I'm not talking about stop loss. I'm refering to daily spending. Yup, the bulls are still charging. If this is a superbull, then it only comes once in 15 years. So we must make fully of this opportunity. Cut daily spending to the bare minimum, no luxury items, no Aunty Kwan, no new clothes, nothing new. Go for the cheapest. Divert most of you money to the stock (but remember to have 5 months of spare ...just in case it turns out wrong). This is one easy time to make money, so squeeze every drop of it.

Saturday, November 11, 2006

Fantasies

Ah...the open profit gets bigger everyday. This is the time we usually fantasized on what we can buy....a new car, a new home, a new hifi or a new Nike. For food lovers, it will be Shark fins everyday.

Stop! Stop! Stop! To tell you the truth, I avoid fantasing about my open profit. Infact, I totally avoid counting my profit except for record purposes at the end of the week. I won't look at the profit figures. It's just make me nervous. Well, every stock needs to do cha-cha-cha. 2 steps front, 1 step back. So if you count your profit everyday, then you will see your profit goes up and down. When it is down, you will start thinking...oh ....I'm loosing that Nike that I dream of.....when it goes up, you add a new item into your wish list. At the end, you will not be able to analyse the stock movement objectively. You will be crowded with emotions. Emotions will just make you deviate from your written plan. And when you deviate from your plan, you will be reckless and with recklessness comes mistakes.

So stop counting the open profits.

Stop! Stop! Stop! To tell you the truth, I avoid fantasing about my open profit. Infact, I totally avoid counting my profit except for record purposes at the end of the week. I won't look at the profit figures. It's just make me nervous. Well, every stock needs to do cha-cha-cha. 2 steps front, 1 step back. So if you count your profit everyday, then you will see your profit goes up and down. When it is down, you will start thinking...oh ....I'm loosing that Nike that I dream of.....when it goes up, you add a new item into your wish list. At the end, you will not be able to analyse the stock movement objectively. You will be crowded with emotions. Emotions will just make you deviate from your written plan. And when you deviate from your plan, you will be reckless and with recklessness comes mistakes.

So stop counting the open profits.

Friday, November 03, 2006

Maemode, L&G, Gamuda

Lots of profit taking this week. Some stocks has been distributed. My analysis says Media and Masteel will consolidate next week. On the other hand, Maemode is showing signs of possible resuming its uptrend. I think funds are buying Frontken, support is still strong. Still looking for an reentry point to get into it.

Maemode: Daily RSI downtrend broken. Possible consolidation bottom at 1.22. Long term trend is still up.

L&G: Moving up slowly?

Gamuda: Resuming the uptrend? The warrants are all good play if this works out.

Maemode: Daily RSI downtrend broken. Possible consolidation bottom at 1.22. Long term trend is still up.

L&G: Moving up slowly?

Gamuda: Resuming the uptrend? The warrants are all good play if this works out.

Saturday, October 28, 2006

Fear the bulls

Everyone is very bullish. Since the day I kept statistic on advance/decline ratio, this is the highest. Bullish counters based on daily charts is at all time high. Volume is also very high. Who will be the guys that will buy high and sell higher? Sugar is the speculative leader for this round rally. What possible reasons that can be used to push the stocks higher? I guess that currency theme will be played again. Then maybe the 3rd quarter result season, and finally the year end Santa theme. I don't know whether it will last until God of Prosperity or not....what I know is not to buy high volume counters at this moment. It's kind of hard to set stops when the stock keep moving up everyday. It's like jumping on a moving train, you will be rewarded if you got the skills, but most of us will just get killed.

Next coming Monday should be a down day....it always a down day during early of the week for the past 2 months. This is because amateurs and professionals buy and sell at different time (you got to read A. Elder book to understand this). Furhermore, the Dow close lower, so sentiment maybe affected. Lets see how does the high volume are absorved.

Next coming Monday should be a down day....it always a down day during early of the week for the past 2 months. This is because amateurs and professionals buy and sell at different time (you got to read A. Elder book to understand this). Furhermore, the Dow close lower, so sentiment maybe affected. Lets see how does the high volume are absorved.

Friday, October 20, 2006

2/3 Stupid

Hmmm...my analysis on Frontken is wrong. The force is very strong. Is it institution buying? I only sold 2/3 of my last holding. So I'm feeling 2/3 stupid. It's hard to being a trader, it's hard to make selling decision. Ride my winners, cut my losers. 6 words and so hard to implement.

Thursday, October 19, 2006

Masteel, Media, Nextnat

Using EMA analysis, KLCI is still in uptrend. Using stochastic or RSI, then it is overbought. In trending times, I think it is better to use EMA for guidance. Overall, there are no bad signs yet. Still sitting tight with my Measat and Wellcall. Maemode & Mems look like not moving. GHLSys kaput liao? Maxis....aiyoh....EPF changing from left hand to right hand.

Masteel: Something breweing underneath.

Media: Looks like continuing the uptrend. My purchase of Media-WA was totally bad timing. Need to buy when it is consolidation. Need to teach myself to follow this rule. At least I break even now (after 3 weeks of waiting).

Nextnat: Looks like a breakout from triangle.

Masteel: Something breweing underneath.

Media: Looks like continuing the uptrend. My purchase of Media-WA was totally bad timing. Need to buy when it is consolidation. Need to teach myself to follow this rule. At least I break even now (after 3 weeks of waiting).

Nextnat: Looks like a breakout from triangle.

Sunday, October 15, 2006

Conspiracy Theory of Short Selling

This is my conspiracay theory on why Bursa defer short selling to next Jan 2007.

Currently we are having our Deepavali/Hari Raya rally, next will be Christmas rally, followed by New Year rally, then it's Chinese New Year rally. You see, we are a multi racial country. So all major races must be kept happy and enjoy the celebration. By the time CNY, the index will be sky high. What do you do when everyone is high? Sell lah...so that's why Bursa is postponing it to next January 2007. To prevent anyone from spoiling the fun.

Then there will be an election conspiracy theory...I'll make up of something..some time when I'm boring.

Currently we are having our Deepavali/Hari Raya rally, next will be Christmas rally, followed by New Year rally, then it's Chinese New Year rally. You see, we are a multi racial country. So all major races must be kept happy and enjoy the celebration. By the time CNY, the index will be sky high. What do you do when everyone is high? Sell lah...so that's why Bursa is postponing it to next January 2007. To prevent anyone from spoiling the fun.

Then there will be an election conspiracy theory...I'll make up of something..some time when I'm boring.

Thursday, October 12, 2006

New High

So today the index breaks new high with high volume. This is not the time to buy. It is the time to wait and see. See how strong is the profit taking and whether there are more people waiting to buy. If the major newspaper publish this in the front page, then beware!

I took a lost in Wahseong this week. Oil and gas not in play anymore? I ignored the technical signs because of my fundamental view for this counter. You see how my so called neutral stand can be easily sway by other factors. I got on the wrong O&G counter.

Since everything is going up, stock selection will be easy now.

Anyhow, using my volume/candle criteria, I took profit on Frontken. I always feel uncomfortable when a counter shoot up too fast. It's like a sprinter that will run out of breath after 100m. I prefer marathon runners counter. Less stressful for the mind.

I took a lost in Wahseong this week. Oil and gas not in play anymore? I ignored the technical signs because of my fundamental view for this counter. You see how my so called neutral stand can be easily sway by other factors. I got on the wrong O&G counter.

Since everything is going up, stock selection will be easy now.

Anyhow, using my volume/candle criteria, I took profit on Frontken. I always feel uncomfortable when a counter shoot up too fast. It's like a sprinter that will run out of breath after 100m. I prefer marathon runners counter. Less stressful for the mind.

Saturday, October 07, 2006

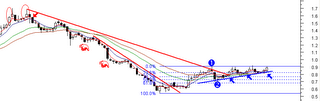

KLCI, Mesdaq & Coastal

Looks like I really need to cut lost fast. My hand is just too slow. Mismanage my Gamuda-WC, from a small profit to a lost. This goes also for Cepat. Entered at the wrong time for Media-WA and MPHB-WB. Still waiting for something to happend with Maemode-WA and GHLSys.

At least got some comfort with Wellcall, Measat, Frontkn and Mems.

Is this a bull or what? Monthly chart shows KLCI got potential to break higher, I do not see any signs of trouble yet (but then again my bullish bias may effect my judgement) I read that many other analysis complaint about low volume, I think that is OK. Low volume means not everyone are convince yet. So, it should be OK to buy. High volume shows everyone is in (students with PTPTN money, auntie with wet market money, and retirees with life savings etc) Then that is the time to sit tight and watch. I always remind myself that professionals buy when everyone is not looking, and sells when everyone is buying. So need to think like the pros. Beside that, need to remember that in any bull move, the blues will move first (Commerze, Tenaga, Maybank), then the 2nd liners, then 3rd, 4th and so on.

I have stopped buying on breakout. Too many times get caught. Now buying during low volume. It's ok for me since my position is so small it won't "move" the market during low activity. Low means the stock has calm down after sudden burst of activity with the long term trend still pointing upwards.

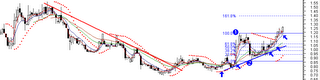

Mesdaq: Weekly RSI hinted that the worse is over for Mesdaq.

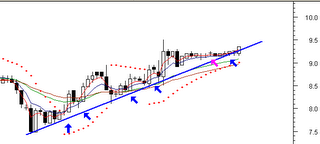

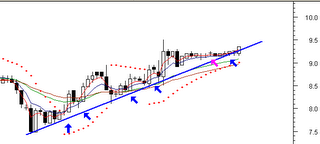

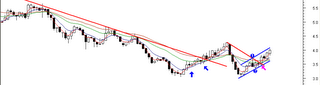

Coastal: Weekly EMA shows that it may be moving up again.

At least got some comfort with Wellcall, Measat, Frontkn and Mems.

Is this a bull or what? Monthly chart shows KLCI got potential to break higher, I do not see any signs of trouble yet (but then again my bullish bias may effect my judgement) I read that many other analysis complaint about low volume, I think that is OK. Low volume means not everyone are convince yet. So, it should be OK to buy. High volume shows everyone is in (students with PTPTN money, auntie with wet market money, and retirees with life savings etc) Then that is the time to sit tight and watch. I always remind myself that professionals buy when everyone is not looking, and sells when everyone is buying. So need to think like the pros. Beside that, need to remember that in any bull move, the blues will move first (Commerze, Tenaga, Maybank), then the 2nd liners, then 3rd, 4th and so on.

I have stopped buying on breakout. Too many times get caught. Now buying during low volume. It's ok for me since my position is so small it won't "move" the market during low activity. Low means the stock has calm down after sudden burst of activity with the long term trend still pointing upwards.

Mesdaq: Weekly RSI hinted that the worse is over for Mesdaq.

Coastal: Weekly EMA shows that it may be moving up again.

Thursday, October 05, 2006

Stalking: Maxis

Friday, September 29, 2006

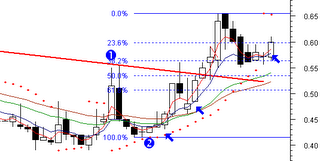

Wellcall, Mems & Maemode

If your stock goes up, better find a reason why. If not, Bursa will issue a query, making everyone nervous and dump it. Then you'll get stressful and have no good night sleep. If it is manipulated, then Bursa should check with the brokers. Find the left and right hand. With today's technology, you can tap phones, intercept emails etc. I'm sure Bursa knows the taikos. Most of the people most of the time will buy because it is up. There is no logic involve in buying, everthing is just emotionl decision. Where got time to read news or DJ Market Talk. With the amount of information available, I just give up.

Hmm....is there an indicator where we can predict when Bursa will issue a query? Maybe Bursa should be transparent about these, protection of minority speculators rights is a must. If we don't speculate, you don't make money. It will be a lose-lose situation.

Wellcall: Going strong after CIMB strong buy call.

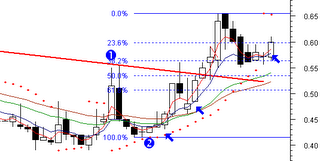

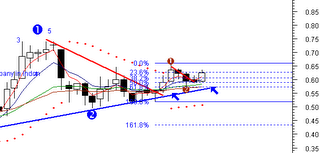

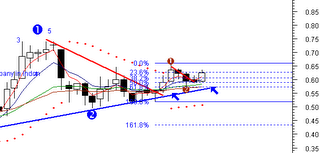

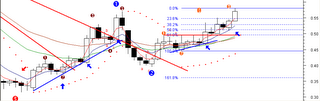

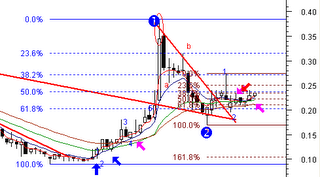

Mems: False break at 0.57. Under going correction. At support line. Possible buy if support holds. If not, it will be ugly for the bulls.

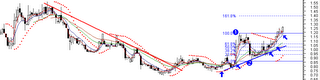

Maemode: After 2 weeks of consolidation, Maemode is continuing the uptrend.

Hmm....is there an indicator where we can predict when Bursa will issue a query? Maybe Bursa should be transparent about these, protection of minority speculators rights is a must. If we don't speculate, you don't make money. It will be a lose-lose situation.

Wellcall: Going strong after CIMB strong buy call.

Mems: False break at 0.57. Under going correction. At support line. Possible buy if support holds. If not, it will be ugly for the bulls.

Maemode: After 2 weeks of consolidation, Maemode is continuing the uptrend.

Wednesday, September 27, 2006

Media

Friday, September 22, 2006

The Greatest Show On Earth

I trade both fundamental and speculative counters. For fundamental counters, the stop are usually set a bit further that speculative shares. Why? Because fundamental counters tend to have slow and steady movement, just like a marathon runner. For speculative, they run like a sprinter, very quickly go out of breath.

But both entry and exit are based on my technical analysis. At least it allows me to stay breakeven :p

Why do I trade speculative counters? Because they move fast and you get your adrenalin rush seeing them move. I'm still not yet a good trader, emotion still exist. It's hard to control it since we are only human. So it's really exciting when you see your stock rises (a happy feeling). When it goes further, you get nervous. (feeling jittery), many questions now pops out, will it go further (a sign of greed), or will I lose my open profit (that's fear). Well, the stock market is the greatest show on earth. Everyone likes to watch it. Look at the brokerage open gallery during a bull rally, it's choke full of auntie and uncles that are spending their retirement in front of the big screen. Now, since we have Internet and mobile phones, we will tend to take a peak at our "bet" every few minutes. Oh yes, the greates show on earth......

But both entry and exit are based on my technical analysis. At least it allows me to stay breakeven :p

Why do I trade speculative counters? Because they move fast and you get your adrenalin rush seeing them move. I'm still not yet a good trader, emotion still exist. It's hard to control it since we are only human. So it's really exciting when you see your stock rises (a happy feeling). When it goes further, you get nervous. (feeling jittery), many questions now pops out, will it go further (a sign of greed), or will I lose my open profit (that's fear). Well, the stock market is the greatest show on earth. Everyone likes to watch it. Look at the brokerage open gallery during a bull rally, it's choke full of auntie and uncles that are spending their retirement in front of the big screen. Now, since we have Internet and mobile phones, we will tend to take a peak at our "bet" every few minutes. Oh yes, the greates show on earth......

Thursday, September 21, 2006

Monday, September 18, 2006

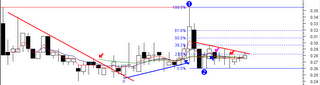

Nextnat, Mems & Frontkn

My instinct told me to buy Tenaga CWs. But as the CW charts did not issue the buy signal even though Tenaga has, I did not buy as I wanted to stick to my rules. The CWs has gone up very fast. I can't enter now as my stop will be too wide and the lost will be too big for me if it goes wrong. So, the question is, if I have the same instinct some time in the future, do I follow it or stick to my trading rules? How do I differentiate inner instinct from emotional influence decision? Or did I get the rules wrongly written? Maybe I should only analyse the mother chart as the mother will influence the movement of the daughter?

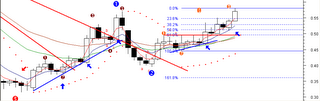

Nextnat: Daily chart indicates consolidation is over.

Mems: A lot of gain in 1 day. Daily is overbought. Currently at the previous resistance. Will the bulls break it?

Frontkn: Will there be a play for this counter? Daily buy signal triggered.

Nextnat: Daily chart indicates consolidation is over.

Mems: A lot of gain in 1 day. Daily is overbought. Currently at the previous resistance. Will the bulls break it?

Frontkn: Will there be a play for this counter? Daily buy signal triggered.

Saturday, September 16, 2006

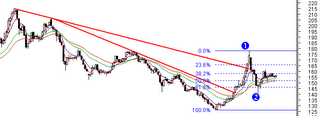

Mesdaq, Tenaga & Measat

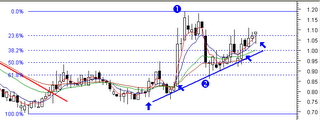

There is a good chance the KLCI index will break the previous high. I'm seeing Maybank and now Tenaga starting to move. Furthermore, penny shares in Mesdaq may have bottomed out.

Mesdaq: Light at the end of the tunnel? A reversal candle may indicate the end of consolidation. Lets see whether the weekly RSI downtrend line can or cannot be broken.

Tenaga: It's this big elephant's time to move. The covered warrants will be a good hedge for this stock. Tenaga-CA (Ex price RM7.96, Ex date 28 Jan 2008) and Tenaga-CB (2 for 1, Ex price RM 4.54, Ex date 19 Oct 2007).

Measat: Maybe at the launch pad for blast off. Satellite launch in Nov 2006 - Jan 2007. Volume still low. Nobody is paying attention yet.

Mesdaq: Light at the end of the tunnel? A reversal candle may indicate the end of consolidation. Lets see whether the weekly RSI downtrend line can or cannot be broken.

Tenaga: It's this big elephant's time to move. The covered warrants will be a good hedge for this stock. Tenaga-CA (Ex price RM7.96, Ex date 28 Jan 2008) and Tenaga-CB (2 for 1, Ex price RM 4.54, Ex date 19 Oct 2007).

Measat: Maybe at the launch pad for blast off. Satellite launch in Nov 2006 - Jan 2007. Volume still low. Nobody is paying attention yet.

Friday, September 15, 2006

Air Asia

Tuesday, September 12, 2006

Monday, September 11, 2006

KLCI & Maemode

Sunday, September 10, 2006

Be neutral

nik271 commented that he believes that Favco's fair value is 0.72. Well that is his opinion or some analyst opinion (if he gets his idea from somewhere) and his style of trading. He may be a value investor who can wait 1 whole year for the stock to reach it's fair value. For me, I have a limited capital. I cannot affort to wait for something that may or may not happen. I need to ride a stock when it is starting to move.

In addition to that, I will not predict where the stock will go but to let the stock tell me where it wants to go. A stock will move when it wants to move. Nobody can force it alone. It needs all the market participants to move it. If you predict where it will reach, then you will have an opinion ingrained inside you. This is a dangerous thinking as you will refuse to read the market neutrally which will result in big financial damage. This mind set is hard to train. That's why most of us are giving our money to someone better than us.

In addition to that, I will not predict where the stock will go but to let the stock tell me where it wants to go. A stock will move when it wants to move. Nobody can force it alone. It needs all the market participants to move it. If you predict where it will reach, then you will have an opinion ingrained inside you. This is a dangerous thinking as you will refuse to read the market neutrally which will result in big financial damage. This mind set is hard to train. That's why most of us are giving our money to someone better than us.

Friday, September 08, 2006

Strike out by Favco and SimeEng

2 strikes this week. Sold out Favco with a loss. I have drawn the wrong channel trendline. It is still in downtrend. No sign of turning. A mistake in jumping in too early.

Another one is SimeEng. No momentum to move up yet. Looks like it is dropping slowly. This loss is smaller as compared to Favco. I just don't want to tie up my capital when there are other oppurtunities available. At least I have released my mind from these losing counters. No point hoping for a miracle.

Another one is SimeEng. No momentum to move up yet. Looks like it is dropping slowly. This loss is smaller as compared to Favco. I just don't want to tie up my capital when there are other oppurtunities available. At least I have released my mind from these losing counters. No point hoping for a miracle.

Tuesday, September 05, 2006

KLCI

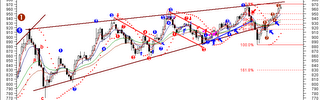

Is it over? Daily chart indicates a correction is imminent. Weekly chart does not yet indicate the trend is over. Possibly the correction will go to 950. The volume does not indicate an exhaustion rally. It is too low. Does this indicate that it is a bear rally? Not possibly because weekly indicators are all positive. Past 2 years weekly RSI analysis shows that there should be 2 overbought peaks before we have a major correction.

My intepretation from all of these is that there will be a mild correction, then another rally, maybe pass 970 to draw out the crowds, then maybe we will have a major correction.

The next move should involve bigger caps as SC is coming hard on small speculative counters. Smart taikos will do the tango to avoid any enquiries (i.e. mems)

A few of my counters stop lost has been hit. Time to weed out the weaklings.

Wednesday, August 30, 2006

Construction Sector & Gamuda

Tuesday, August 29, 2006

Currently trying out a new indicator for my exit signal: Parabolic SAR.

I notice that the blue chips are starting to move again. Is the days of the small caps over? Maybe because that a certain hedge fund is being investigated, now every taiko is keeping a low profile.

Wellcal: Currently under consolidation. Down volume is reducing. A good run for those who has subscribed to the IPO.

Commerze: Moving up again. Commerze-CA (Ex price 4.59, Ex date 18 Nov 2007) is technically under value.

I notice that the blue chips are starting to move again. Is the days of the small caps over? Maybe because that a certain hedge fund is being investigated, now every taiko is keeping a low profile.

Wellcal: Currently under consolidation. Down volume is reducing. A good run for those who has subscribed to the IPO.

Commerze: Moving up again. Commerze-CA (Ex price 4.59, Ex date 18 Nov 2007) is technically under value.

Saturday, August 26, 2006

Nextnat, Maemode & GHLSys

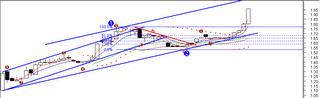

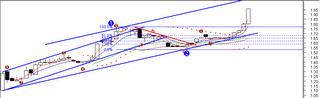

Nextnat: Weekly and monthly charts positive. The bulls are very keen to run. Gap covered on Friday. Daily chart shows consolidation.

Maemode: All charts indicate up. But still stuck at 1.10 level for almost 2 months. If it can rally, then the warrant (Ex price RM1.00, Ex date 19 Sept 2010) will be an excellent play.

GHLSys: I'm still getting mixed signal from Weekly and Monthly chart. Can't confidently bet that it will go up.

Friday, August 25, 2006

Side income

This cross my mind many times. My capital is limited, the number of counters i can trade are limited by my mind to keep track on them. The amount I trade is limited by my risk strategy. So what else can I do to increase my income? I don't want to have advertisement cluthering my whole blog and hoping people will click on it. I don't think it is worth it and most of all, I don't believe the advertisement.

It is possible to sell my trading plan? Will people be willing to pay for it? I mean, I am still learning. I don't get 100% correct up counters, but I do get 100% correct in avoiding downtrend counters. So is this good enough? This is the K-economy. So it is possible to sell my so called "expertise"? I need to recoup the money I spent on all those trading books....he he. Ah, this is just a crazy idea during a boring time.

Anyway, I don't have any official qualifications. So the SC will go after me if I provide this service. Better not get my life too complicated.

It is possible to sell my trading plan? Will people be willing to pay for it? I mean, I am still learning. I don't get 100% correct up counters, but I do get 100% correct in avoiding downtrend counters. So is this good enough? This is the K-economy. So it is possible to sell my so called "expertise"? I need to recoup the money I spent on all those trading books....he he. Ah, this is just a crazy idea during a boring time.

Anyway, I don't have any official qualifications. So the SC will go after me if I provide this service. Better not get my life too complicated.

Gamuda, Frontkn, Favco

Gamuda: The bull are still pushing up higher. It should rechallenge 4.26 again. Monthly chart -> all says going up. A good leverage is Gamuda-WC (Ex price RM3.75, Ex date 21 Aug 2007). However, it is stuck in a symmetrical triangle (from daily chart) and almost reaching its apex. So technically, any breakout will not be strong.

Frontkn: Maybe this time it will go up. Candles are white, EMA are up. A good sign?

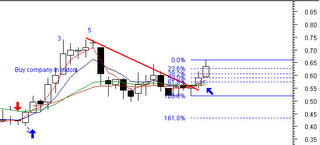

Favco: Broken the down trendline? A strong confirmation is a close above 0.76.

Thursday, August 24, 2006

Boring game

I'm bored. The index is inching up. But the general market is going nowhere. Stocks are just like human, they have very short attention time. Most of the time, they just wonder aimlessly.

I'm just doing ok with my selection. Wellcal amazed me. SimeEng not moving. Cepat is like a rollercoaster. Mems is full of suspicious queues (sekejap ada, sekejap tak ada).

I sold out with a lost for Bahvest and LNGres. Bahvest is slowly sinking. LNGres is trapped in range.

Gamuda may show signs of uptrend. Not yet confirm. The warrant will be a good play (Gamuda-wc). Maemode also attracted my attention, the warrant is also a good play.

When nobody is buying, it is time to go shopping. Buy when the queue is low (of course the long term trend must be up). When everyone is buying, take a seat and watch their action. Remember, the crowd is always wrong.

So, I'm still waiting. It is a boring game.

I'm just doing ok with my selection. Wellcal amazed me. SimeEng not moving. Cepat is like a rollercoaster. Mems is full of suspicious queues (sekejap ada, sekejap tak ada).

I sold out with a lost for Bahvest and LNGres. Bahvest is slowly sinking. LNGres is trapped in range.

Gamuda may show signs of uptrend. Not yet confirm. The warrant will be a good play (Gamuda-wc). Maemode also attracted my attention, the warrant is also a good play.

When nobody is buying, it is time to go shopping. Buy when the queue is low (of course the long term trend must be up). When everyone is buying, take a seat and watch their action. Remember, the crowd is always wrong.

So, I'm still waiting. It is a boring game.

Monday, August 21, 2006

KLCI, Mesdaq, Construction & 2nd Board Index

Monday, August 14, 2006

Mems, GHLSys & Frontken

Mems: Looks like the bulls has broken through 0.495 with good volume.

GHLSys: The bulls maybe winning. Still no buy signal yet.

Frontken: The bears are still in charge. The 4 Aug 06 signal was just a bull shit. This shows that relaying only on candlestick analysis is not 100% accurate, must used it with other Western indicators. The more indicators that says the same thing, the better.

Thursday, August 10, 2006

Volume in Iris

I just gone through the share holding change for Iris. I must remind you that the following data cannot be verify 100% as I got it from a 3rd party:

3 Aug 06 - Total volume transacted for Iris is 1,363,167 lots

PB Priam transaction for that day:

Acquired 461,947 lots

Disposed 637, 596 lots

Total 1,099,543 lots

If my calculation and assumption are correct, that means only one fund activities is creating 77% of the total transaction! Wow! Can this be real? Is there hidden meanings in this? I don't know.

3 Aug 06 - Total volume transacted for Iris is 1,363,167 lots

PB Priam transaction for that day:

Acquired 461,947 lots

Disposed 637, 596 lots

Total 1,099,543 lots

If my calculation and assumption are correct, that means only one fund activities is creating 77% of the total transaction! Wow! Can this be real? Is there hidden meanings in this? I don't know.

Wednesday, August 09, 2006

Waiting for the bull

Waiting, waiting and waiting. KLCI index is moving up slowly but the volume is shrinking.

Will there be a pre-budget rally? Chart wise indicates it is still going up. Nobody dares to buy. The Iris sentiment is still influencing the market. This counter is game over. Who will be the next leader?

Will there be a pre-budget rally? Chart wise indicates it is still going up. Nobody dares to buy. The Iris sentiment is still influencing the market. This counter is game over. Who will be the next leader?

Monday, August 07, 2006

Losing in Unit Trust

Did you read the story about EPF contributors losing their shirt in unit trush schemes? It says "...80% of EPF contributors who invested their savings in unit trusts posted losses totalling RM600 million". Wow!

What happened? How can so called professionals with degrees and certifications lose? The answer is they are just human. Human makes mistakes. So are they. And not all of them are good. Maybe 5% of the funds are good but the rest are rubbish that only knows how to fatten their own purse.

The first question to ask is: Is it worth the risk paying them to earn an extra few percent return above EPF return?

In my honest opinion, it depends on how good are they. If they can return 20% yearly, I would say it is worth the risk. If the return is less than 10%, then I think it is safer putting your money in EPF than letting them handling it. If they can give you that return in a good market, imagine what will they give you in a bad one.

The next question is how do you know they are good? Well look for information about their pass performance. They ask about who are the fund managers. Always keep track of this important person. This is not easy as you will only know this when you get your quarterly interim report.

The next thing to do is never trust the person trying to sell you any trust fund products. They are just sales person whose income depends on sales. Maybe only a few are honest. It is better deal with a person that is independent from any funds as his opinion will not be bias.

Investing is not easy if you are the lazy type that just wants to put your money in and forget about it for the rest of the year. You need to be active and pay attention to your portfolio. In other words, you still need to do your home work.

What happened? How can so called professionals with degrees and certifications lose? The answer is they are just human. Human makes mistakes. So are they. And not all of them are good. Maybe 5% of the funds are good but the rest are rubbish that only knows how to fatten their own purse.

The first question to ask is: Is it worth the risk paying them to earn an extra few percent return above EPF return?

In my honest opinion, it depends on how good are they. If they can return 20% yearly, I would say it is worth the risk. If the return is less than 10%, then I think it is safer putting your money in EPF than letting them handling it. If they can give you that return in a good market, imagine what will they give you in a bad one.

The next question is how do you know they are good? Well look for information about their pass performance. They ask about who are the fund managers. Always keep track of this important person. This is not easy as you will only know this when you get your quarterly interim report.

The next thing to do is never trust the person trying to sell you any trust fund products. They are just sales person whose income depends on sales. Maybe only a few are honest. It is better deal with a person that is independent from any funds as his opinion will not be bias.

Investing is not easy if you are the lazy type that just wants to put your money in and forget about it for the rest of the year. You need to be active and pay attention to your portfolio. In other words, you still need to do your home work.

Notion, BCTTech & Bahvest

Friday, August 04, 2006

Wellcal, SimeEng & Frontken

Wellcal: Everyday goes up 1-2 cents. Still in uptrend.

SimeEng: Good close today. The pattern suggest that it should rechallenge 1.52. Any weakness is a good buy.

Frontken: Looks like it has found a possible bottom at 0.315. Daily chart -> bullish reversal candle. It may possibly head higher from here.

Subscribe to:

Posts (Atom)