| World | Monthly | Weekly | Daily | Note |

| S&P500 | Up | Up | Neutral | R=1.12k, S=1.01k |

| DJI | Up | Up | Up | R=11k. |

| NasdaqComp | Up | Up | Neutral | R=2.18k |

| Nikkei 225 | Neutral | Down | Down | Next R=11k |

| Kospi | Up | Neutral | Down (-) | R=1.9k. |

| SSECI | Up | Up | Neutral (-) | R=3.5k. S=2.6k. Finding base. |

| HSI | Up | Neutral (-) | Neutral (-) | R=23.5k, S=20k. |

| TWII | Up | Up | Neutral (-) | R=7.9k. S=7k |

| STI | Up | Up | Up | R=2.8k. S-2.52k |

| JKSE | Up | Neutral (-) | Neutral (-) | R=2.5k. S=2.3k |

| SENSEX | Up | Up | Neutral (-) | R=17.6k |

| AORD | Up | Neutral (-) | Neutral | R=4.9k |

| NZX50 | Up | Neutral | Down | R=3.2k |

| FTSE | Up | Up | Neutral | R=5.4k |

| DAX | Up | Neutral | Neutral | R=6.15k |

| RTSI | Up | Up | Neutral (-) | R=1.5k |

| Bovespa | Up | Up | Up | R=66k |

Ads

Monday, November 30, 2009

World Weekly Summary

Dubai spooked the markets world wide. This could mark a top. Cannot say whether this is the top yet.

Commodity Summary

Lots of traveling during the weekend. Therefore, this is late.

| Commodity | Monthly | Weekly | Daily |

| Gold | Up | Up | Up |

| Crude Oil | Up | Up | Down (-) |

| Crude Palm Oil | Neutral | Up | Up |

| Rough Rice | Up | Up | Up |

Thursday, November 26, 2009

Bursa Malaysia Weekly Summary

My system relies on the lagging indicator (i.e. EMA). Therefore, I can only say that a turning point has occurred only after the fact. So, today, I'm going to say that KLCI has hit the top and will now start to move down, gradually at first, but will pick up speed later on (just like a rolling train). Red flags that I see:

- Weekly RSI has shown bearish divergence.

- Weekly uptrend RSI has been broken.

- Weekly MACD has gone into negative territory.

I managed to get out of my construction counters with some skin left. It was really a bruising punch. I'm not buying calls anymore. In fact, I'm looking at puts now. There are not many puts out there in Bursa Malaysia, I think that you can guess which one I will go long.

So, enjoy your long weekend and hope that we will not turned into Thanksgiving turkeys come Monday.

| Malaysia | Monthly | Weekly | Daily | Note |

| FBM KLCI | Up | Up | Neutral (-) | R=1.3k, S=1.2k. |

| Finance | Up | Up | Neutral (-) | R=11k, S=9.5k. |

| Construction | Up | Neutral (-) | Down (-) | R=250, S=220. Serious correction |

| Plantation | Up | Up | Up | R=6.4k, S=5.8k. |

| Property | Up | Neutral | Down | R=820, S=760. Correction |

New Structured Warrants fr OSK

The following call warrants fr OSK will be listed on 30 Nov 2009:

Is OSK smelling blood?

| New Warrants | Expiration | Type | Ex Price | Ratio |

| MRCB-CB | 25/02/2011 | Call | MYR 1.5000 | 2 : 1 |

| CIMB-CH | 25/02/2011 | Call | MYR 12.8000 | 20 : 1 |

| GENTING-CR | 25/02/2011 | Call | MYR 6.8000 | 10 : 1 |

| SANDS-C1 | 18/06/2010 | Call | HKD 9.5000 | 8 : 1 |

Is OSK smelling blood?

Wednesday, November 25, 2009

Gold Manipulations

Watch this video about gold manipulations. Yes, let's buy physical gold and squeeze the manipulator's balls. Maybe gold can shot up to USD 3-4k / oz due to this short squeeze.

Part 1

Part 2

Part 3

New Structured Warrants

Here we go again. After 7 weeks of no new structured warrants, we now have 8 new ones that will be listed on 26 Nov 2009. 4 of them is on Maxis.

I wonder, does this means that the big boys have a bearish view on the market? I hope that the market will whip them into pulp :p

I wonder, does this means that the big boys have a bearish view on the market? I hope that the market will whip them into pulp :p

| New Warrants | Expiration | Type | Ex Price | Ratio |

| MMCCORP-CA | 30/11/2010 | Call | MYR 2.3000 | 4 : 1 |

| DRBHCOM-CA | 30/11/2010 | Call | MYR 1.0000 | 2 : 1 |

| MAXIS-CA | 24/05/2010 | Call | MYR 5.0000 | 6 : 1 |

| MAXIS-CB | 24/11/2010 | Call | MYR 5.5000 | 7 : 1 |

| MAXIS-CC | 20/12/2010 | Call | MYR 5.0000 | 8 : 1 |

| MAXIS-CD | 31/03/2011 | Call | MYR 4.8000 | 8 : 1 |

| KNM-CD | 24/11/2010 | Call | MYR 0.8000 | 1 : 1 |

| KNM-HA | 24/11/2010 | Put | MYR 0.8000 | 1 : 1 |

Sunday, November 22, 2009

Commodity Summary

CPO: Breakout. Should go back down to test the breakout.

Crude Oil: Fake buy signal (refer to to my previous post). Looks like strong selling at 80.00. I still think that crude oil will hit 100 because the weekly RSI is in the 60s (bullish) but not yet hit 70s (overbought). I just don't know when.

The summary for the rest:

| Commodity | Monthly | Weekly | Daily |

| Gold | Up | Up | Up |

| Crude Oil | Up | Up | Neutral |

| Crude Palm Oil | Neutral | Up | Up |

| Rough Rice | Up | Up | Up (+) |

One thing that I observe is that grain price are going up again (i.e. soybeans, wheat, oat, rice). Is this due to a weak USD or falling grain supply?

Saturday, November 21, 2009

World Weekly Summary

SSECI: Looks like it is going towards 3500-3800.

STI: Looks like it has broken out from ascending triangle pattern. May go parabolic if can hold on to the gain. Next resistance is at around 3250.

The summary for the rest of the world:

| World | Monthly | Weekly | Daily | Note |

| S&P500 | Up | Up | Neutral (-) | R=1.12k, S=1.01k |

| DJI | Up | Up | Up | R=11k. |

| NasdaqComp | Up | Up | Neutral (-) | R=2.18k |

| Nikkei 225 | Neutral (-) | Down (-) | Down | Next R=11k |

| Kospi | Up | Neutral | Neutral (+) | R=1.9k. |

| SSECI | Up | Up | Up | R=3.5k. S=2.6k. Finding base. |

| HSI | Up | Up | Up | R=23.5k, S=20k. |

| TWII | Up | Up | Up | R=7.9k. S=7k |

| STI | Up | Up | Up | R=2.8k. S-2.52k |

| JKSE | Up | Up (+) | Up (+) | R=2.5k. S=2.3k |

| SENSEX | Up | Up | Up | R=17.6k |

| AORD | Up | Up | Neutral (-) | R=4.9k |

| NZX50 | Up | Neutral (-) | Down (-) | R=3.2k |

| FTSE | Up | Up | Neutral (-) | R=5.4k |

| DAX | Up | Neutral | Neutral | R=6.15k |

| RTSI | Up | Up | Up | R=1.5k |

| Bovespa | Up | Up | Up | R=66k |

You can still that BRIC and anything related to BRIC (HK and Taiwan) are still going strong. Nikkei is going down, could be due to deflation. US is still holding up. Overall, mixed signals around the world, which I think is good because herding behavior is not highly correlated.

Bursa Malaysia Weekly Summary

KLCI: Looks like losing steam. Still unable to clear the resistance zone of 1280-1310.

The summary for the various sectors:

| Malaysia | Monthly | Weekly | Daily | Note |

| FBM KLCI | Up | Up | Up | R=1.3k, S=1.2k. |

| Finance | Up | Up | Up | R=11k, S=9.5k. |

| Construction | Up | Up | Up (+) | R=250, S=220. |

| Plantation | Up | Up | Up | R=6.4k, S=5.8k. |

| Property | Up | Neutral | Down (-) | R=820, S=760. Correction |

The weakest sector now is property. Looks like the government is successful in taking out the fuel for the property rally. I still think that the plantation is going to rally big. I'm still thinking on whether to sell out my property holdings and put it into plantation. I need more evidence for this move.

Friday, November 20, 2009

International Reserves of BNM

| Date | MYR (billion) | USD (billion) |

| 30-Oct-09 | 334.6 | 96.0 |

| 13-Nov-09 | 334.8 | 96.1 |

Source.

Hot money is flowing into Asia but I don't see it for Malaysia.

Thursday, November 19, 2009

Video for Technical Analysis

Wanna learn about technical analysis? I found a series of videos from youtube.com that talks about technical analysis. The following is lesson 1:

Follow the series for other lessons.

Follow the series for other lessons.

Wednesday, November 18, 2009

Crude Oil Futures

The daily chart is giving a buy signal. Looks like it has broken out of the falling flag pattern. Some say the price is going up due to rising demand (better economy) while others say that it is due to reduced maximum production. The only thing I see is that it is a bull since April 2009.

Disclosure: Long in USO-C1

Monday, November 16, 2009

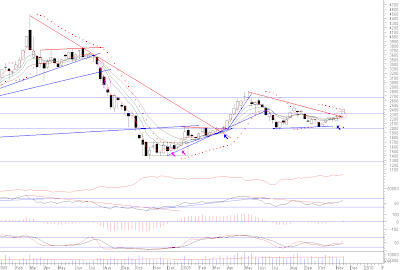

Genm

Genm Daily Chart

This should be it. Waited for almost 3 months for the correct signal. Most probably broken the triangle pattern. Should be challenging the downtrend line soon. Good chance of breaking the downtrend line if the breakout from the triangle pattern is valid.

There are 5 CWs and 1 PW (see below):

In my opinion, Genm-CK offers the best value.

Disclosure: Long in CW.

Sunday, November 15, 2009

My Precious

Do you have precious metal in your investment portfolio? Looking at the monthly gold, silver, platinum and palladium chart, gold has hit a all time high but the rest are all lagging. Will silver, platinum and palladium play catch up?

Commodity Summary

Looks like CPO has broken out from the triangle pattern. So, look out for plantation play.

For the rest:

| Commodity | Monthly | Weekly | Daily |

| Gold | Up | Up | Up |

| Crude Oil | Up | Up | Neutral |

| Crude Palm Oil | Neutral (+) | Up (+) | Up |

| Rough Rice | Up | Up | Neutral (-) |

World Weekly Summary

DJI: Looks like it has broken out of the downtrend!

S&P 500: This one also has broken out of the downtrend line. The only concern for DJI and S&P 500 is the decreasing volume that accompany this breakout.

The summary for the rest of the world:

| World | Monthly | Weekly | Daily | Note |

| S&P500 | Up | Up | Up (+) | R=1.12k, S=1.01k |

| DJI | Up | Up | Up | R=11k. |

| NasdaqComp | Up | Up | Up (+) | R=2.18k |

| Nikkei 225 | Up | Neutral | Down | Next R=11k |

| Kospi | Up | Neutral | Down | R=1.9k. |

| SSECI | Up | Up | Up | R=3.5k. S=2.6k. Finding base. |

| HSI | Up | Up | Up | R=23.5k, S=20k. |

| TWII | Up | Up | Up (+) | R=7.9k. S=7k |

| STI | Up | Up | Up (+) | R=2.8k. S-2.52k |

| JKSE | Up | Neutral | Neutral | R=2.5k. S=2.3k |

| SENSEX | Up | Up (+) | Up (+) | R=17.6k |

| AORD | Up | Up (+) | Up (+) | R=4.9k |

| NZX50 | Up | Up | Neutral | R=3.2k |

| FTSE | Up | Up | Up (+) | R=5.4k |

| DAX | Up | Neutral | Neutral (+) | R=6.15k |

| RTSI | Up | Up | Up (+) | R=1.5k |

| Bovespa | Up | Up | Up | R=66k |

Looks like we are all going back to our merry way of creating bubbles. May we not be the last one to buy at the top.

Saturday, November 14, 2009

From Deflation To Inflation

A good article on how deflation becomes inflation.

Friday, November 13, 2009

Bursa Malaysia Weekly Summary

KLCI: Still going up, but beware! Volume is lower than the previous week. All possible Fibonacci retracements have been reached. The next possible resistant is at 1300. If this is broken, then most probably the gap at 1350 will be closed.

Sector summary:

| Malaysia | Monthly | Weekly | Daily | Note |

| FBM KLCI | Up | Up | Up | R=1.3k, S=1.2k. |

| Finance | Up | Up | Up | R=11k, S=9.5k. |

| Construction | Up | Up | Neutral | R=250, S=220. Correction |

| Plantation | Up | Up | Up (+) | R=6.15k, S=5.8k. Correction |

| Property | Up | Neutral (-) | Neutral | R=820, S=760. Correction |

Look out at the plantation sectors. It got a big boost on Monday, but then no life. From the CPO chart, looks like a breakout has occurred (I will post the chart in the commodity summary).

I'm currently teaching myself on how to trade the index by playing the index call warrants. This derivative instrument has a different behavior and I'm trying to adjust myself to it. Only when I feel that I'm familiar with it that I will trade the index futures. Past futures mistakes still haunt me. Just need to rewire my mind.

Thursday, November 12, 2009

Peak Oil

I'm surprise that Malaysian media seldom talk about this peak oil theory. According to the believers, oil production has or will reach peak production soon. This means the end of cheap energy for human development.

For the skeptics, they will always cite the IEA report that says that oil is abundant. Well, this story in the Guardian about a whistle-blower that alleges that IEA lies about how much oil that the world still has. A must read for everyone.

For the skeptics, they will always cite the IEA report that says that oil is abundant. Well, this story in the Guardian about a whistle-blower that alleges that IEA lies about how much oil that the world still has. A must read for everyone.

Sunday, November 08, 2009

Commodity Summary

Gold: Only 6 days into the month and gold has made a move that is equivalent to last month's gain. Therefore, I don't think gold will make more gains unless an euphoria grips the common people.

Crude Oil: It seems that sellers are very aggressive at USD80. However, since weekly RSI has not moved into the overbought zone, I am expecting more gain.

The summary for the rest are:

| Commodity | Monthly | Weekly | Daily |

| Gold | Up | Up | Up (+) |

| Crude Oil | Up | Up | Neutral |

| Crude Palm Oil | Down | Neutral | Up |

| Rough Rice | Up | Up | Up |

World Weekly Summary

S&P 500: Looks like it is going to challenge the downtrend line again. At Friday's (6 Nov 2009) closing, I don't see the possibility of a successful break yet. The index should built a base a current level so that the challenge can be successful.

SSECI: Gave a buy signal on Monday (2 Nov 2009). Looks like it will challenge 3480 resistance.

For the rest of the world, the signal is mixed. Each market is at different phase of correction. I believe that this is good. What I fear most is a strongly correlated up and down market. The former indicates euphoria, while the later indicates panic.

| World | Monthly | Weekly | Daily | Note |

| S&P500 | Up | Up | Neutral | R=1.12k, S=1.01k |

| DJI | Up | Up | Up (+) | R=10.1k. |

| NasdaqComp | Up | Up | Neutral | R=2.18k |

| Nikkei 225 | Up | Neutral | Down | Next R=11k |

| Kospi | Up | Neutral | Down | R=1.9k. |

| SSECI | Up | Up | Up (+) | R=3.5k. S=2.6k. Finding base. |

| HSI | Up | Up | Up (+) | R=23.5k, S=20k. |

| TWII | Up | Up | Neutral | R=7.9k. S=7k |

| STI | Up | Up | Neutral | R=2.7k. S-2.52k |

| JKSE | Up | Neutral | Neutral | R=2.5k. S=2.3k |

| SENSEX | Up | Neutral | Down (-) | R=17.6k |

| AORD | Up | Neutral (-) | Down (-) | R=4.9k |

| NZX50 | Up | Up | Neutral (-) | R=3.2k |

| FTSE | Up | Up | Neutral | R=5.4k |

| DAX | Up | Neutral | Down (-) | R=6.15k |

| RTSI | Up | Up | Neutral | R=1.5k |

| Bovespa | Up | Up | Up (+) | R=66k |

Subscribe to:

Posts (Atom)