When I started trading, I always have problem of buying or selling. I grow nervous. All sort of questions comes into my mind. Is this a good price? Is it cheap now? Is it expensive? What happened if the price drop after I buy? etc etc. My heart will beat faster when I want to click the final "OK" button. I was full of adrenalin in trading stocks!

As time goes by, I manage to learn new tricks, new thinking to pull the trigger, like a cold blooded killer.

First thing, you must have a system that says when to buy, when to sell. You must take the signal no matter what others (economist, traders etc) say. Until you change your system due to the failure of your method, you must adhere to it.

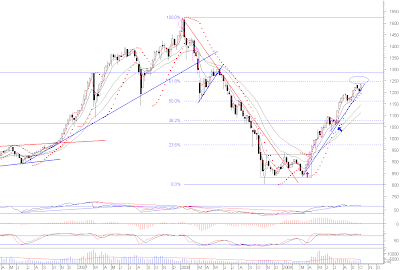

Next, don't think about the price that you are paying. You cannot view the stock as cheap or expensive. What I do is to view the direction of the stock. There are 4 possible answers: Up, Down, Going nowhere (consolidation/bottoming/topping), I don't know.

You need to know that a stock moves like this: directionless , trending, directionless, trending, directionless, trending, .....and so on. The directionless could be just a consolidation or change of trend.

So, your trading system must be able to identify "up", "down" and "consolidation or topping or bottoming". The "I don't know" is due to insufficient data point. When you get insufficient data point, then obviously, you need to wait for a more clearer signal.

When you can think logically, then you will get rid of your emotion during the buying/selling phase. You will not second guess your action. You will become a cold blooded trader.