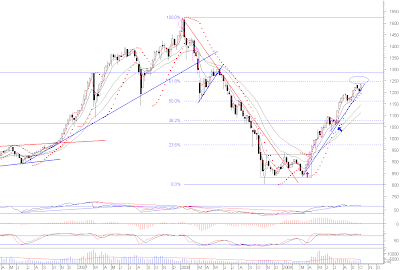

KLCI Weekly Chart

KLCI Weekly Chart

Market is overbought once more. So, I guess the explanation for going up is that this is the pre-budget rally. Oh, whatever. I prefer to look at individual stocks to make my trading decision. Every sectors except ACE market, is up now.

| Malaysia | Monthly | Weekly | Daily | Note |

| FBM KLCI | Up | Up | Up (+) | R=1.3k, S=1.15k. Overbought |

| Finance | Up | Up | Up (+) | R=11k, S=9.5k |

| Construction | Up | Up | Up (+) | R=250, S=220 |

| Plantation | Up | Up | Up (+) | R=6.15k, S=5.8k |

| Property | Up | Up | Up (+) | R=820, S=760 |

| FBM ACE | Up | Neutral | Neutral | Triangle pattern. |

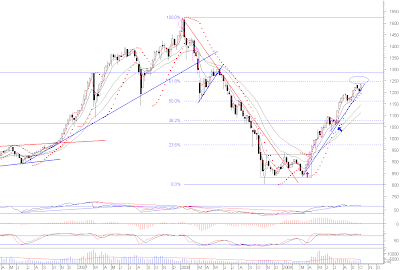

Next week, pay attention to the property sectors. IJMLand, Glomac, and recently BRDB have moved (I only monitor stocks with warrant). There may be some laggards left which have not make any substantial movement. I think that if the property index (chart below) can close above 800, then that can be the 1st signal to get a little bit more aggressive with property counters. If the property index closes above 820, I think we will see euphoria. Currently, I have IJMLand-WA, E&O-WA and BRDB-WA.

Property Sector Weekly Chart

Property Sector Weekly Chart

No comments:

Post a Comment